I’ve been fascinated with cognitive biases for a while now – actually ever since reading Dan Ariely’s famous book Predictably Irrational. A cognitive bias is basically a systematic error that happens when processing information. This error can greatly impact how people make decisions and judgments.

In the book, Ariely explores a number of these biases alongside experiments he ran that demonstrated just how irrational we as human beings can be. It was both surprising and eye-opening.

I quickly realized that understanding these biases and recognizing when they occur could greatly improve my general decision-making, so I started to explore them in more detail. I’ve written about several of them over the years, including The Anchoring Bias, The Confirmation Bias, The Halo Effect, and The Peak-End Rule, but one of the most critical cognitive biases we encounter on a daily basis is Hyperbolic Discounting.

What is Hyperbolic Discounting?

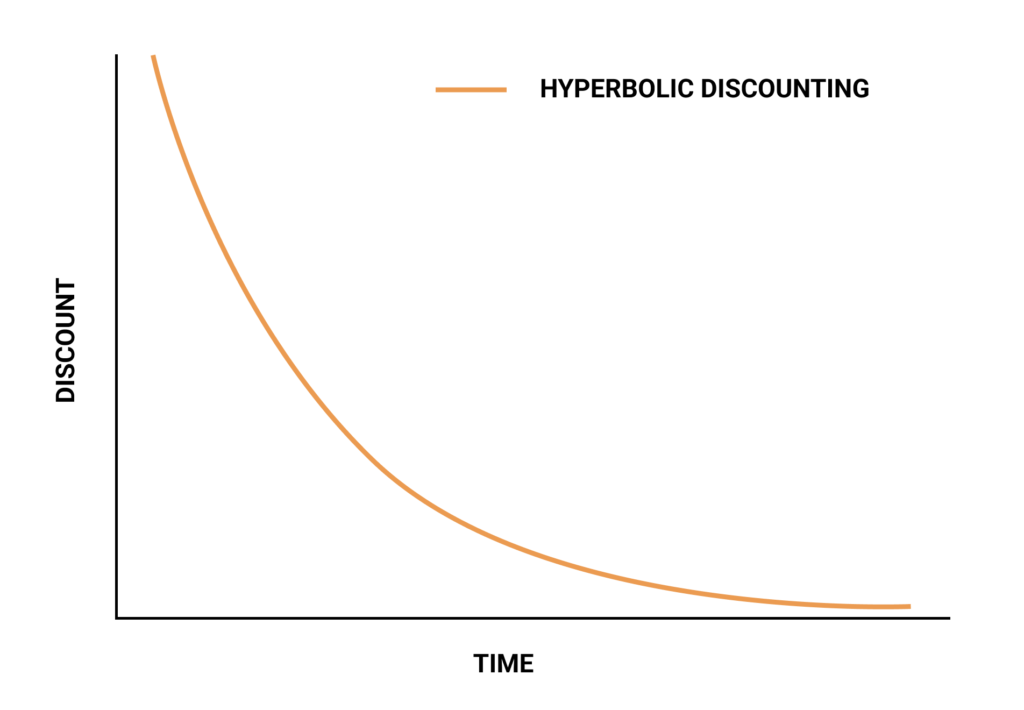

Hyperbolic discounting is our need to prioritize immediate rewards over delayed rewards, even if those delayed rewards are better.1 In simpler teams, when posed with the option, we tend to pick the easy, immediate outcome to satisfy our needs today, instead of delaying our gratification for a bigger payout.

These are a few everyday examples of this that will certainly be familiar:

- Shopping: we choose to splurge on things we don’t need rather than putting our money to work

- Media: we choose to consume all forms of content that is typically not enhancing our lives or forming valuable long-term habits

- Smoking: we choose the quick rush of dopamine at the expense of our long-term health

- Politics: we prioritize short-term gains that satisfy our constituents, rather than long-term value in the bigger picture

- Procrastination: we delay doing the hard work till tomorrow, rather than taking action today

I can go on and on, but you get the idea. Due to this prioritization of short-term gains over long-term rewards, we tend to make terrible decisions in our daily lives. To think of it in another way, the value we place on rewards tends to decrease with time.

The longer we have to wait for the reward the less valuable it is perceived. This phenomenon is particularly present when it comes to procrastination. Studies have shown that we are often delaying productivity in exchange for instant gratification.2

Should I go to the gym today? Nah, I’ll go tomorrow. Should I sit down and write that post? Maybe when I’m in the right headspace after a good night’s sleep. I’ll just relax tonight.

We tend to perceive our future self who will end up doing the delayed work as some sort of superhero – the you of tomorrow will be energized, motivated, and inspired. The reality is they are much the same as the you of today.

The question is why do we make this trade-off? It seems there are two key reasons behind the irrationality of Hyperbolic Discounting.

- We like a sure thing. Expecting something in the future removes some assurance of certainty from the equation. That uncertainty is what often pushes us to choose the immediate options. The reality is it is hard for us to understand long-term consequences and outcomes, so we choose immediacy rather than waiting.

- It’s hard to be patient. Waiting is difficult – it takes self-control that many of us don’t have. This reminds me of the famous Stanford marshmallow experiment conducted in 1972 by Walter Mischel. In the experiment, kids have two options: eat a single marshmallow immediately or wait ten minutes and get two marshmallows. A great example of both self-discipline and hyperbolic discounting, although a little unfair to expose kids to such a dilemma.

Basically, we’re all little kids staring at that marshmallow, trying not to devour it. It can be done, but it takes to resolve.

How to Overcome Hyperbolic Discounting

Understanding what it is is step one, but how do we stop ourselves from making this mistake over and over again? There are a few strategies we can leverage to help us navigate these situations.

Automate longer-term decisions

If we can implement systems that force these decisions and/or remove them from our hands completely, we can ensure we are always prioritizing long-term gains. A great example of this is automatically depositing funds into an investment vehicle of your choice. Rather than having to make that decision, it just happens passively, ensuring we can’t self-sabotage.

Break down big goals

Another approach is to break down bigger outcomes that are harder to grasp into smaller wins. By doing so, you are able to better understand their worth and value. They become more tangible and the rewards become more apparent.

Prime your mind

Sometimes, all it takes is trying to understand what such long-term rewards would look like. Priming your mind and thinking of your future self if you made certain decisions, helps you better comprehend the impact of your decisions. Imagining this future state can help you make better decisions.3

Leverage the feeling of loss

Alternatively, thinking of the loss instead of the reward can be enough to change your mind. George Loewenstein and Richard H. Thaler ran a study in 1989 that explored a West Virginia Law change that penalized high school dropouts with the consequence of also losing their driver’s license.

This change compounded the loss but also made it feel much more real. Dropping out is harder to understand in the short term, but losing your driver’s license is a very clear penalty. The result? Dropout rates decreased by a third.4 In a similar way, find the losses that may come from picking instant gratification or manufacture your own penalties for doing so.

Hyperbolic Discounting is something that we encounter every single day, but that doesn’t mean it’s always right. Sometimes it does make sense to choose the immediate rewards, especially when it comes to money.

In theory, if we are offered $50 today versus $100 in 6 months, we should choose the $100. But that ignores certain concepts around money – most importantly the reality that guarantees around money are rare. But beyond that, if we were to put that money to work today, we could very well have more than $100 in 6 months.

This is to say, no cognitive bias is a hard and fast rule, context matters, but they do explain some of the more peculiar decisions we make on a daily basis. In the case of Hyperbolic Discounting, try to first recognize these situations in your life and then leverage the strategies above to help you navigate the challenges of immediate rewards.

SOURCES

1. Samson, A. (2017). The Behavioral Economics Guide 2017. Behavioral Science Solutions.

2. YEŞİLKAYALI, D. (n.d.). PROCRASTINATION AND FUTURE DISCOUNTING. The Journal of International Social Research, 7(30).

3. Hershfield, H. E., Goldstein, D. G., Sharpe, W. F., Fox, J., Yeykelis, L., Carstensen, L. L., & Bailenson, J. N. (2011). Increasing Saving Behavior Through Age-Progressed Renderings of the Future Self. Journal of Marketing Research, 48(SPL). doi:10.1509/jmkr.48.spl.s23

4. Loewenstein, G., & Thaler, R. (1989). Anomalies: Intertemporal Choice. The Journal of Economic Perspectives, 3(4), 181-193. Retrieved July 11, 2020, from www.jstor.org/stable/1942918